Your Queen Anne Market Report for April 2020

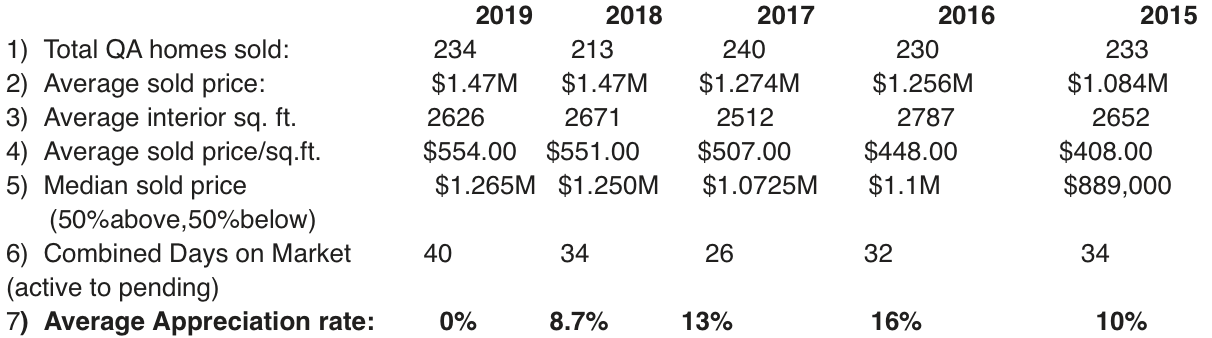

Strange times. As I stated in last month’s newsletter, the real estate market was showing earlier than normal signs of a coming spring market that was going to be gangbusters. That was true until March 25 when non-essential services were ordered to stay at home. As a small personal example, I sold a home in Magnolia on March 12 that was listed for $975K. There were nine offers on it with nine pre-inspections. My clients and I were very fortunate to have been the winner at a sold price of $1.205M. We were also very lucky that we were able to fast track the closing to March 27th because since then, several lenders, led by Wells Fargo, have temporarily suspended granting “jumbo” loans(loans over $741K that are not government secured). These larger loans, if available, face tightening qualifications for buyers. Until that restriction is lifted, it is going to have a negative effect on Queen Anne listings since nearly all of the homes on the Hill are well over $1M. Out of curiosity, I just searched SFD on QA that have sold since being listed after March 24.There were two. Normally by now, we would be in a very active spring market with homes up to $1.5M flying off the shelves and being driven up in price. As an example, of the 15 homes that have sold in the last 30 days since my last report, 8 have sold for more than list, but these all went into contract before March 25th. Incidentally, the winner in that group for this month was 3603 13thWest, listed for $1.295M and sold for $1.615M! Until the restrictions, the average sold price/square foot was steadily rising and reached $575.00.

My prediction for where the market will be, once we have people going back to work, is that the pent up demand for QA homes will be very strong and when we get listings coming on the market(that I suspect are currently being held off the market) we will have a gangbusters market once again. My best guess is that will start to happen in mid-June. I don’t see our economy getting back to strength until October or so. Because of low interest rates continuing as well as low inventory, I do not see prices coming down. I do see only vacant homes come onto the market until the all-clear is issued since most sellers will not want strangers in their home if they are still living there. Actually , for the past year, about 65% of the homes coming on market have been vacant anyway(my observation looking at the data over the last year).

QA Pendings and Solds for April 2020 Report the active and sold data for the preceding 30 days as usual and have added a link to Bill Gates discussing the pandemic and what he sees needs to happen before we are in the clear.

And that’s the way Steve sees it…

Stay safe

A Senior’s Guide to Aging in Place Safely

For many seniors, finding a way to safely age in place — or stay at home for as long as possible — can be difficult. There may be health or mobility issues involved, or the home may not be a viable living space anymore due to the presence of stairs or because it’s too large. For those who don’t have long-term care planned, it can be a scary and stressful thing to consider not living at home anymore, so it’s important to find ways to modify your home that will make it safe and accessible.

Fortunately, there are some simple ways you can do this, especially if your home is one level. In some cases, you may need the help of a contractor who can come in and do an assessment of your home. While this is a pricier option, you may be eligible for assistance with funding. Look online for information specific to your state, or start here.

Go room to room

Assessing your home for safety issues is important, so take a look around with a discerning eye. Think about not only your present needs, but your future ones as well. If you have health issues at the moment, consider how they will affect you four or five years from now. Will you have trouble using the stairs? Will you be able to use the bathroom safely? Walk through your home and look for potential issues so that you can get a feeling for what needs to be done and how to create a budget.

Eliminate the potential for injuries

Eliminating the potential for injury is imperative. According to the National Council on Aging, roughly one in every four Americans over the age of 65 falls each year, and many of those falls occur in the home. The bathroom is one of the rooms with the most potential for injuries because slick surfaces and stepping in and out of the bathtub can lead to a serious fall. Fortunately, there are several things you can do to make the bathroom safer, from adding grab bars and a shower seat to refinishing the tub with non-slip flooring. You could even remove the bathtub altogether and install a zero-entry shower.

Look for an accessible home

If staying in your house isn’t an option, it’s important to look in your area for accessible homes that you can afford. These are homes that already have a senior’s specific needs in mind, from open floor plans that allow a wheelchair to move about unrestricted, to wider doorways and lower countertops. Remember that in many cases, location is just as important as the home itself.

Use color and light to your advantage

Color and lighting can make a huge impact in your home, especially if you or your spouse have vision issues. You might paint the wall behind the toilet and sink a contrasting color than the rest of your bathroom, for instance, or add new lighting to pantries, closets, and hallways to help prevent stumbles and allow you to find things more easily.

Finding ways to make your home safer will not only benefit you now, but also for years to come. Aging in place is important to many seniors who don’t have a plan for long-term care or who want to spend their post-retirement years at home, but it’s imperative to make sure your house is up to par. Consider all your options and talk to your loved ones about your plans so you can garner their support. With a good plan and the right help, you can make sure that your golden years are everything you hoped they would be.

The Life Expectancy of Your Home

Image Source: Shutterstock

Every component of your home has a lifespan. Common questions asked by homeowners include when to replace the flooring or how long to expect their siding to last. This information can help when budgeting for improvements or deciding between repairing and replacing when the time comes. We’re all familiar with the cliché: They just don’t build things like they used to. And while this may be true when it comes to brick siding or slate roofing, lifespans of other household components have increased in recent years. Here are the life expectancies of the most common household items (courtesy of NAHB):

Appliances: Among major appliances, gas ranges have a longer life expectancy than things like dishwashers and microwaves.

|

Appliance |

Life Expectancy |

| Oil-burning Furnace | 20 years |

| Heat Pump | 16 years |

| Gas Range | 15 years |

| Electric range / Refrigerator / Dryer | 13 years |

| Electric / Gas Water Heater | 10 years |

| Garbage disposal | 10 years |

| Dishwasher / Microwave / Mini Fridge | 9 years |

Kitchen & Bath: When choosing your countertops, factor in the life expectancies of different materials.

|

Kitchen / Bath Item |

Life Expectancy |

| Wood / Tile / Natural Stone Countertops | Lifetime |

| Toilets (parts will require maintenance) | 50+ years |

| Stainless steel sink | 30+ years |

| Bathroom faucet | 20+ years |

| Cultured marble countertops | 20 years |

| Kitchen faucet | 15 years |

Flooring: If you’re looking for longevity, wood floors are the way to go. Certain rooms in your home will be better suited for carpeting, but you can expect they’ll need replacing within a decade.

|

Flooring Material |

Life Expectancy |

| Wood / Bamboo | Lifetime |

| Brick Pavers / Granite / Marble / Slate | 100+ years |

| Linoleum | 25 years |

| Carpet | 8 – 10 years |

Siding & Roofing: When choosing roofing and siding for your home, climate and maintenance level factor into the life expectancy of the material. However, brick siding and slate roofing are known to be dependable for decades.

|

Siding / Roofing Material |

Life Expectancy |

| Brick Siding | 100+ years |

| Aluminum Siding | 80 years |

| Slate / Tile Roofing | 50+ years |

| Wood Shingles | 30 years |

| Wood Siding | 10 – 100 years (depending on climate) |

Are extended warranties warranted?

Extended warranties, also known as service contracts or service agreements, are sold for all types of household items from appliances to electronics. They cover service calls and repairs for a specified time beyond the manufacturer’s standard warranty.

You will have to consider whether the cost is worth it to you. For some, it brings a much-needed peace of mind when making such a large purchase. Also consider if the cost outweighs the value of the item. In some cases it may be less expensive to replace a broken appliance than to pay for insurance or a warranty.

Your Queen Anne Market Report for March 2020

“As the economic storm clouds on the horizon in early 2019 cleared up, we saw buyers return in droves, taking advantage of ultra-low mortgage rates,” said Zillow economist Jeff Tucker. “Our first look at 2020 data suggests that we could see the most competitive home shopping season in years, as buyers are already competing over near-record-low numbers of homes for sale. That is likely to mean more multiple-offer situations, and that buyers will have a harder time finding the perfect fit for their families. The good news for buyers is that low mortgage rates are helping to make home ownership more affordable, and home builders are responding to the hot housing market by starting construction on more homes than at any time since 2007.”-Zillow

I could not agree more and I liked the way the above was concisely written so I thought I would pass it along. So far this year, what I am seeing on the Hill is much more demand than last year at this time. While January and February are always low inventory months, this year the demand is much greater and as a result, I think this spring is going to be gangbusters again as I said in last month’s newsletter. Homes priced under $1M sell especially fast. As an example, 1916 11th West, a busy section of 11th going down to 15th West, listed for $900K, sold in less than a week. It had 2 bedrooms, 1 bath, unfinished basement, no yard and the back of the home was next to a new condominium project. It was so close that if you wanted to borrow some mustard from the neighbor, you wouldn’t even have to leave your home to do it.

Insanely low interest rates are a major part of this demand as they are at their lowest in 50 years. This is mainly due to the stock market suffering from corona virus fears and investment money flowing into 10-year Treasuries for safety. I see these low interest rates staying around probably through the rest of the year. Mortgage brokers are swamped with requests for re-financing which is what happens when rates go this low. Also, first time buyers are getting into the market now with larger numbers because rents are not going down and at a certain point, they can buy a home for not much more per month than the rent they are currently paying (if they have the down payment). In short, I am predicting that this spring will be crazier than last spring, so great for sellers (and buyers if they can get into contract on a home).

I have posted a video below that shows you a short video on the current Seattle market from our Windermere economist, Matthew Gardener. He addresses the virus outbreak and his prediction on how it will affect our market.

The winner of last month’s home that went most over list price is 2900 1st North, a beautiful Craftsman, listed for $1.395M and selling for $1.685M! The demand is back in force!

Read the full report by clicking here.

And that’s the way Steve sees it…

Make it a great month and stay healthy!

Your Queen Anne Market Report for February 2020

Well we have gone from only 5 active listings last month to 15 currently. Looking at the last 30 days of sales on the Hill, it looks like we are going to have another great spring market due to how quickly new listings coming on the market have gone into escrow. We have had 10 sales in the last 30 days with an average market time of only 8 days. This certainly demonstrates that demand is alive and well for Queen Anne homes. The low inventory is the only factor that is keeping the sales from going even higher. The most popular price ranges for these sales is under $1.5M and especially active is anything listed under $1M. This makes sense of course because there are more buyers in this range than in price ranges over $1.5M. You can look at the data in the attachment if you like.

The national and local economy is very strong which is also underpinning this activity. Interest rates have been declining for the last six weeks or so due to all the money going into safe haven 10 year Treasury bonds. The more money that flows into those bonds, the lower their yields and consequently mortgage rates which stand around 3.5% (for a conforming loan amount for buyers with at least a 760 credit score and sufficient income). As long as tariffs are an issue and the corona virus, I see rates staying at this level. With rents skyrocketing and with mortgage rates this low, more younger buyers are moving into the market place instead of renting. The problem is usually lack of down payment, so I have started to see some banks offering zero down loans again. I do hope we have learned from our mistakes in 2007! Frankly, looking at the big picture, as long as unemployment stays low(3.6%), inflation remains under control(1.6%) and interest rates stay low, business and employment will continue to be profitable and consumers will continue to spend money which accounts for about 67% of our national GDP. As a small example of how optimistic I am about this spring, the home that sold for the most over list price in the last 30 days was 112 West McGraw, listed for $1.15M and selling for $1.345M! This is very positive considering it was in the dead of winter and on a very busy street!

As an side, I want you to know that this year, I will be offering a $2,000 credit towards staging, plus a custom movie and colorized floor plans in addition to professional high resolution photos for any new listings. I am trying to give you as much value as possible to help you sell your home for maximum dollar.

And that’s the way Steve sees it…

Make it a great month!

Working with a Local Real Estate Professional Makes All the Difference

Some Highlights:

- Choosing the right real estate professional is one of the most impactful decisions you can make in your home buying or selling process.

- A real estate professional can explain current market conditions and break down what they will mean to you and your family.

- If you’re considering buying or selling a home in 2020, make sure to work with someone like me who has the experience to answer all of your questions about pricing, contracts, and negotiations.

Source: Keeping Current Matters

MATTHEW GARDNER – WILL THERE BE A RECESSION IN 2020?

Your Queen Anne Market Report for January 2020 with 2019 Market Summary

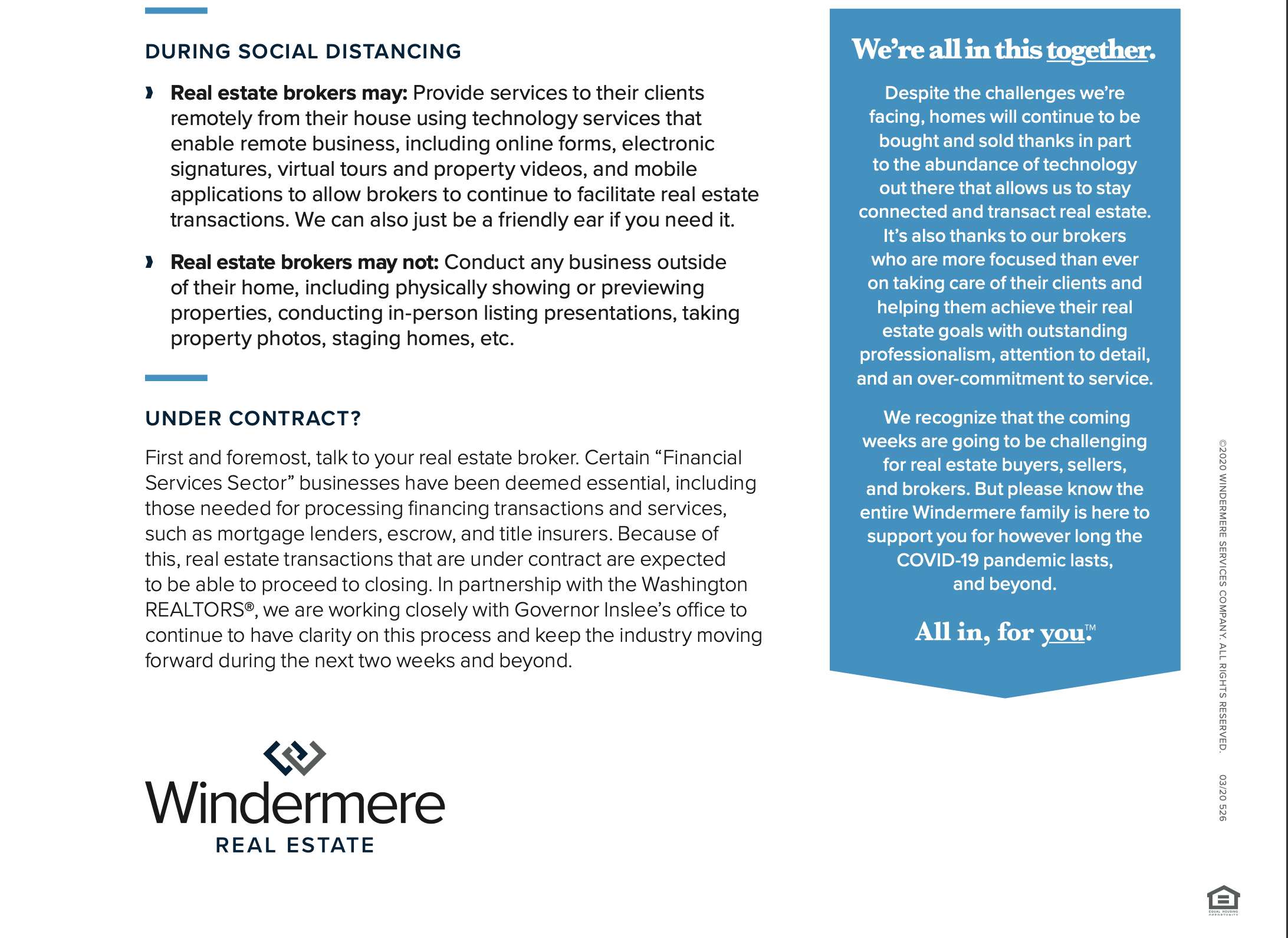

I hope you all had a wonderful Holiday season and were able to take a break from work for a few days to relax and re-group! Now, let’s jump right in and look at a summary of the homes sold on Queen Anne for 2019. This data comes from the NWMLS and does not include condominiums or multi-family dwellings and contains only single family homes on the Hill that sold in 2019.

In looking at the data above, the first thing you will notice is that statistically there was no average appreciation during 2019 from 2018. I am flabbergasted at that number because I know many homes did appreciate last year. I know my raw data from the NWMLS is correct and complete. One factor in this lower average appreciation number is there were 65 homes that sold for less than $1M which is 28% of the total annual sales; a number larger than most previous years. This larger percentage has worked to counteract any increase in the average sold price of all homes sold. It is related to the significant number of price reductions homes have had this year before going into escrow. Another indicator is to look at the median sold prices between the two years. The median, as you probably know, is the price that an equal number of homes on the Hill sold for above and below that $1.265M median. This number does indicate a small gain of about 1% in price over last year. Please see attachment for all of the 234 homes that sold on the Hill last year with the details of each. (The computations have been made by the MLS computer so no chance of mathematical error on my part if you happen to be wondering that!)

At present, we have only 5 active homes listed for sale on the Hill. This number will be increasing over the next three months as we approach spring and prices begin to rise once again with increasing demand. BTW, the grand prize for the home that sold for most over list price in 2019 goes to 2120 2nd Avenue West, a fixer on a large lot in a wonderful location listed at $1M and sold for $1.250M. Last year, 45 homes sold for more than list price although many of them sold for just slightly more. With a strong local and national economy, I am confident we will see more appreciation in prices this year. Also, the state excise tax on the sale of a home has actually gone down for homes at $1.5M or less. Over $1.5M it has doubled. “A man’s money is never safe when the legislature is in session”-Mark Twain.

And that’s the way Steve sees it… Don’t forget to have a little fun every day.

Finding Your Second Home in Seattle After Retirement

You’ve worked hard your whole life, so now it’s time to relax in style. Like many retirees, you’ve had a vacation property in the back of your mind for a while, but you aren’t entirely sure how to go about making that dream a reality. It’s not easy, as the average cost of owning a second home is $700 a month — and that doesn’t even include the mortgage. But if you’re ready to commit to owning a second home in Seattle, here’s some advice to make sure you end up with a sound investment, not a money pit.

Settle the Financing

Before getting started, it’s important to know how much house you can actually afford. Now is a great time to take a close look at your financial situation. Afterward, you can get down to business. If you can pay cash up front, that’s great, but if not, consider borrowing against your primary residence, in which case it must be worth more than you owe the bank. There are other ways to finance, but they may mean more risk than you’re willing to take.

And don’t forget those other expenses. There’s routine maintenance, such as heating, air conditioning, and plumbing, and if your home needs professional work done, you’ll also need to tack on the cost of hiring a contractor. There are some jobs you can do on your own, but keep in mind that if you start a project you’re ultimately not qualified to do and need a pro to complete it, you’ll end up spending more than if you’d hired a specialist in the first place. You could offset these costs by renting out the home when you’re not there, but keep in mind the costs of utilities and property management services if you take this route.

Find the Right Area

Once your budget is set, it’s time to take a look at your schedule. You want to make sure you’re at your vacation home often enough to justify the money you’re spending. You may get the most out of the house if it’s within striking distance of your primary residence or accessible to other family members as a place to gather for reunions.

Seattle, of course, is a wonderful spot for a second home, and there a number of different neighborhoods to choose from, depending on what you want. Ballard, for example, is considered one of the city’s “hippest neighborhoods,” according to Turnkey. Although the area began its life as a fishing village, it’s now the home of coffee shops, cafes, and a number of renowned restaurants. Queen Anne, meanwhile, is more historic and picturesque, and it offers a number of Victorian homes that might catch the eye of those looking for a property with character. Regardless of what you’re after, Seattle has a little something for everyone.

Rent It First

You’ve found the right area… maybe. You may want to consider renting for a while before buying so you can be sure. For starters, how was the travel? If it seemed a bit too long (and you’re not a fan of cramped airline seats), then that’s a sign you’re too far from home. And the weather? It may have been unusually warm when you came here on vacation for the first time, but now you get to see what it’s really like. Does it have all the amenities you want to be close to, like shopping, bars, and restaurants?

Cut Insurance Costs

Insurance is one of those hidden costs for second homes, but there are ways to keep your premiums low. First, shop around for the best coverage option, and don’t just go with your mortgage provider. There are also adjustments you can make to the property to reduce payments. These include actions like installing burglar alarms (which start as low as $29 per month, but can save you hundreds in insurance premiums over the year), as well as fireproofing and removing tall trees near your home.

Plan for Maintenance

This may not be necessary if you’ll be making frequent visits throughout the year. If not, then you’ll need to look into other options for upkeep, according to HouseLogic.com. You could hire a property manager, who will normally find suitable staff to open and close your property while handling guests and payments if you’re renting it out during your absence. Hiring a caretaker, on the other hand, will save you money. You’ll need to check references, though, as they’ll be going in and out of your place to check on the utilities and inspect for damage.

Hopefully, at the end of all this pondering and planning, you’ll have found a place in Seattle to call your home away from home. Just make sure to plan and prepare wisely so you can really make the most of every moment you spend at your vacation abode.

Image via Pixabay

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link