The only positive aspect of the current trade war that I can determine is that it is scaring investors into the bond market and consequently lowering yields and mortgage rates. The other “secure” investment, gold, has risen significantly and now has a market price of around $1500/ounce, up from $1250/ounce prior to about 90 days ago. Lower interest rates are always good for buyers and sellers of course. I expect mortgage rates to be at this level through the rest of the year.

Despite the low rates, home prices in King County have fallen 7% in the last year primarily due to rising inventory which has increased an average of 12%. This has also increased market times. Market times for QA homes have risen from 28 days to 39 days for the past 45 day period. Remember when our market time was about 6 days(or less)? Fortunately, homes on Queen Anne have continued their upward trend, although certainly more slowly than the preceding 6 years. I did a sampling of homes that sold in 2018 from 1/1/18-7/1/18 and we had 135 sales of single-family homes.

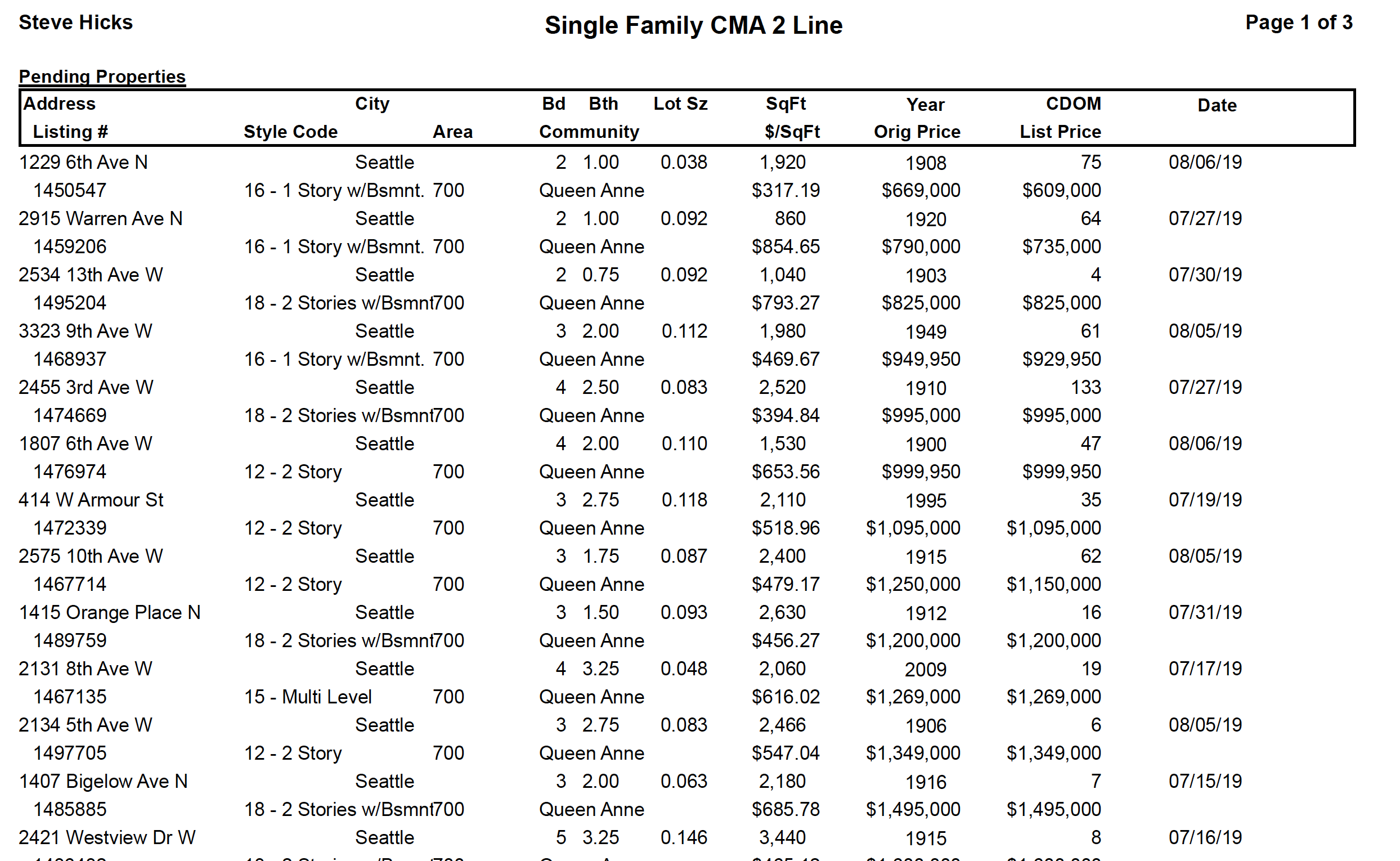

For the same period this year, that figure was 169, a 25% increase. Currently we have 38 homes for sale on the Hill as of today and 16 pending sales in the last 45 days which signals a 42% pendings/actives ratio(see attachment). That still indicates a seller’s market. Wages in Washington have risen 5.5% which if rates stay low, will help buyers purchase higher priced homes.

The home that sold for the most over list in the last 45 days was 2435 1st North, listed for $998,000 and selling for $1,050,000. Multiple offers are down in properties over $1.2M and when they occur, do not significantly raise purchase prices like they used to.

And that’s the way Steve sees it…Click here to view report.

Have a great month!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link